- Contents

In the past we’ve discussed GeoPoll’s findings on topics such as mobile money, and food security, but by tapping the growing reach of the mobile phone in emerging markets, we can also learn about preferences of an increasingly important consumer class. The middle class in many African nations is growing quickly, and with that comes increased spending power. In Sub-Saharan Africa, the World Bank forecasts an economic growth of 5.2% in 2014, up from 4.7% in 2013, especially in countries such as Sierra Leone and the Democratic Republic of Congo.

Advertisers are quickly turning to Africa to promote their brands, and Africa’s total share of ad spend is expected to grow significantly over the next decade. But very little is known about these markets: in the past, market research firms have not focused on emerging nations, which means that many companies and large brands are targeting audiences they know very little about. Information on preferred brands, buying habits, and target demographics has been largely based on guesswork, as until now there has been no reliable way to reach consumers.

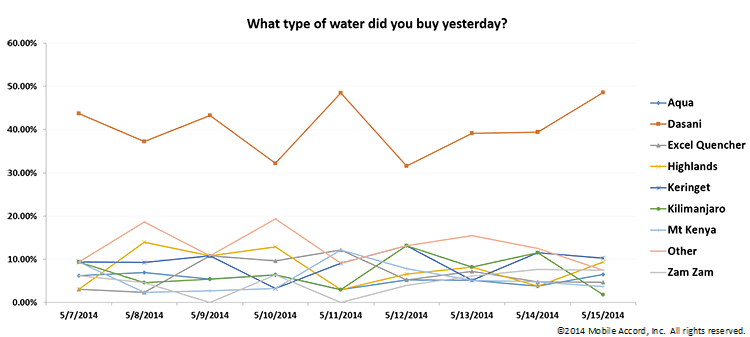

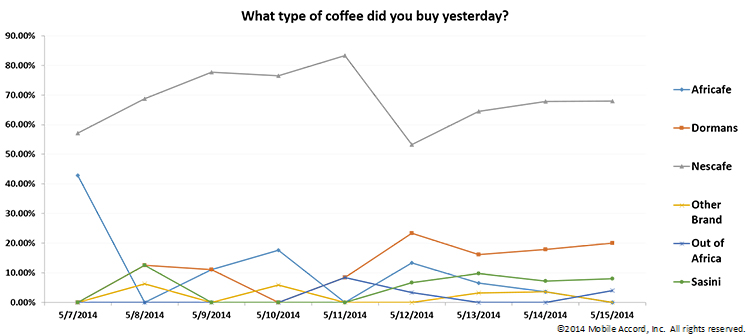

The mobile phone is changing all of that, and at GeoPoll we have been running surveys to determine the most popular brands of soft drinks, water, coffee, and more. As shown below, we asked about purchasing habits in Kenya for several drink categories, first asking users if they had bought a type of drink the day before, and then asking what brand they bought.

The results give us a real-time look into the popularity of brands across Kenya: perhaps unsurprisingly Fanta, Coca-Cola, and Sprite are the most popular soft drinks, and there is a noticeable gap between those three and other brands, including Pepsi. Over 15% of respondents, and on many days over 20%, reported buying Fanta, Coca-Cola, or Sprite the day before, but less than 5% reported buying Pepsi the past day.

Dasani has a clear lead on the bottled water market in Kenya, and even when less consumers reported purchasing Dasani water the previous day, it is still ahead of all other brands. Coffee is another product where a clear market leader emerges, in this case Nescafe. Ketepa tea, which is a local Kenyan tea brand, is the most popular tea drink.

These datasets demonstrate the power of the mobile phone in delivering reliable data on shopping habits, and other GeoPoll survey methodologies can also track brand perception over time. This enables brands to effectively target audiences before they run ad campaigns, determine how many people have seen past advertisements, and track what type of consumer is actually buying their product, which will help them break into these increasingly important markets.