- Contents

In recent years, Africa has witnessed a profound transformation in how information is disseminated and consumed. This shift has been primarily driven by the advent of social media, which now competes with traditional media for the attention of millions across the continent.

To understand the dynamics between these two media forms, GeoPoll conducted a survey in three countries – Ghana, Kenya, and South Africa – in June 2024 with a sample size of 2,454 participants. This report provides an in-depth analysis of social media and traditional media usage and consumption in Africa, highlighting key trends, including:

- Factors that influence the choice of media.

- News content and consumption

- Most reliable source of news and information

- Media and shaping of public opinions

- Social media and news consumption

- Paid news services

How frequently do you consume news and information?

The survey aimed to determine how much time most users spend consuming media and to reveal insightful trends. An overwhelming 86% of users engage with media on a daily basis, indicating a high level of media integration into their everyday lives. Meanwhile, 8% of respondents prefer weekly media consumption, possibly reflecting a more selective approach to media engagement. Lastly, 4% of users rarely consume media, which might be attributed to factors such as limited access to media platforms, lack of interest, or alternative ways of staying informed and entertained.

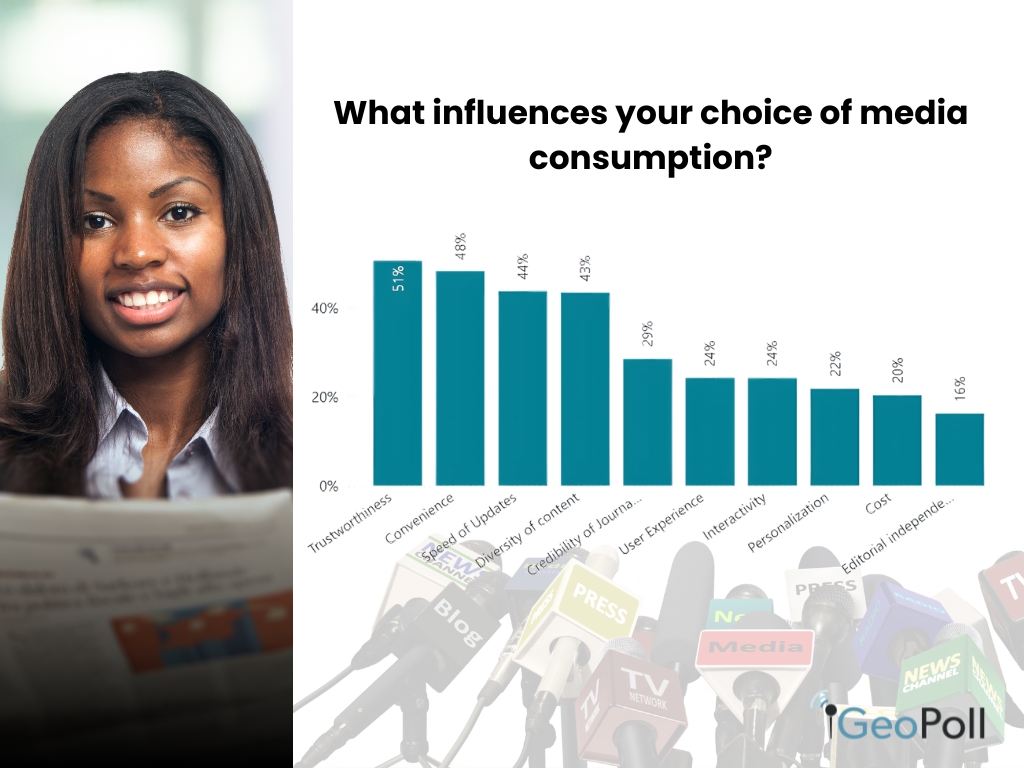

What influences your choice of media consumption?

Different media channels reach different audiences, so the choice of media depends on various factors. According to the survey, 51% of people prioritize trustworthiness when consuming a particular media, followed closely by convenience at 48% and speed of updates at 44%. Please refer to the table below for more detailed information.

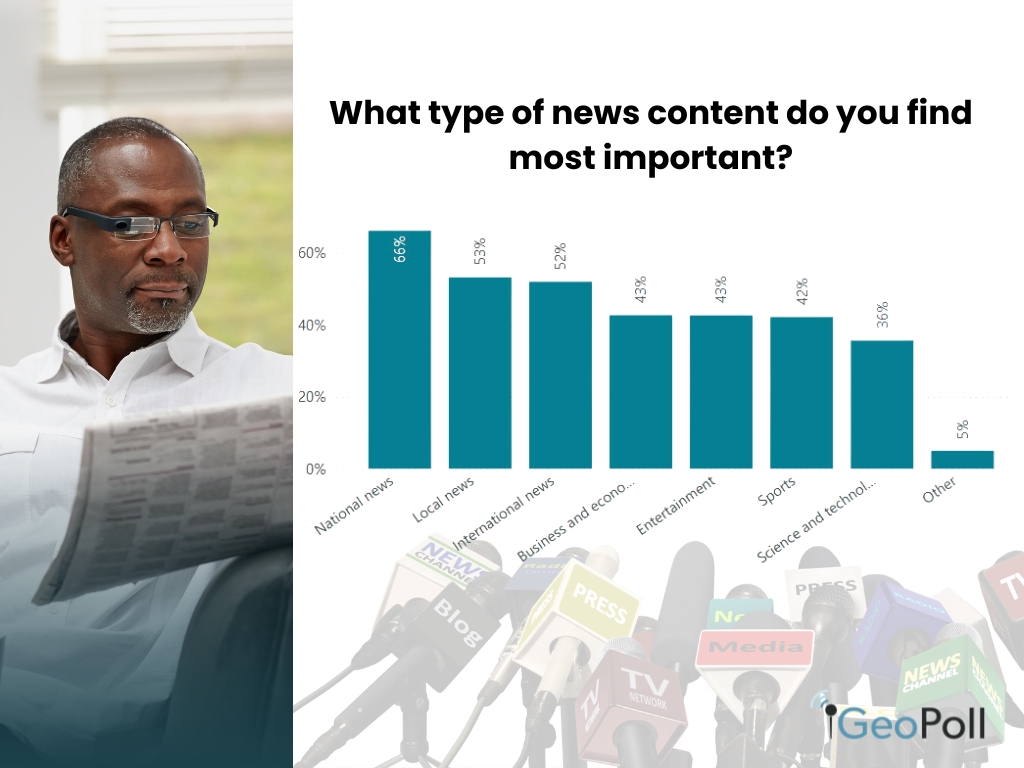

News Consumption

The survey reveals diverse news preferences among Africans. We noted that 66% are interested in national news, indicating a focus on country-wide issues and strong civic engagement. Another 53% prefer local news, valuing community-specific information. Furthermore, 52% are interested in international news, demonstrating awareness of global events and their impacts.

Moreover, when asked how their media consumption has changed in the past five years, the majority (70%) reported an increased use of digital platforms. 10% mentioned access to a broader range of sources, and 8% preferred quick updates.

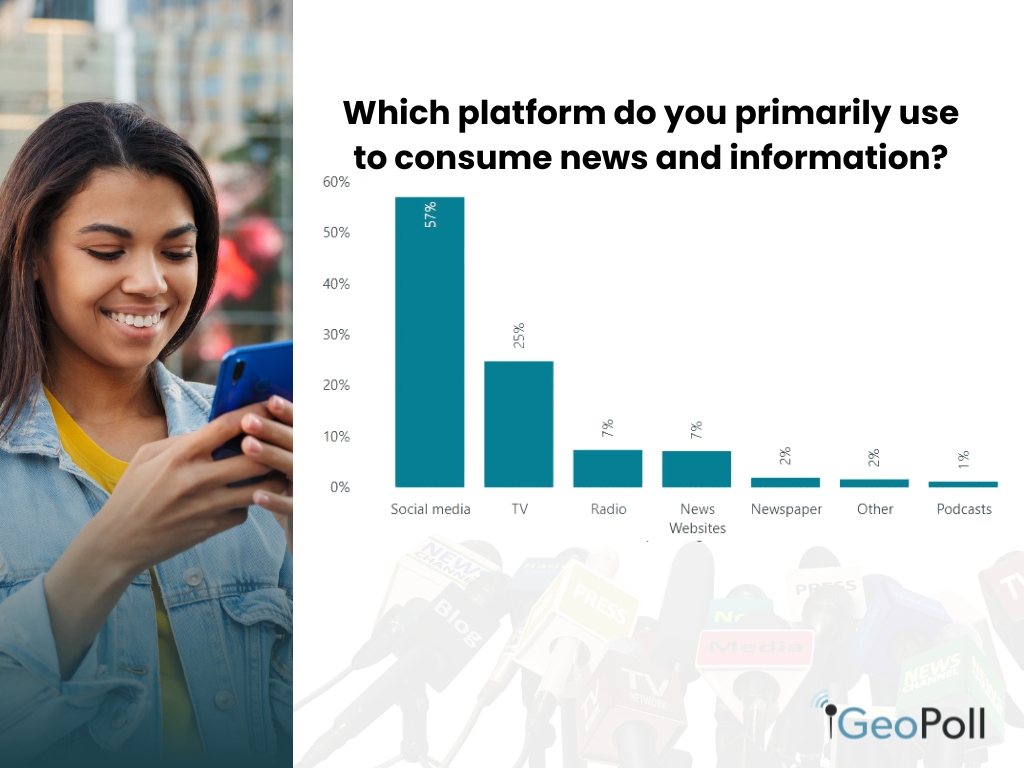

The preferred platform for news and information consumption.

The way people consume media is changing. The survey findings reveals that, 57% of people prefer social media for immediate and interactive content, especially younger people. TV comes next at 25%, showing that it still plays a significant role in delivering news and entertainment. Radio and news websites are tied at 7% each, catering to more specific and niche audiences.

GeoPoll’s recent study on Social Media Penetration in Africa revealed that Facebook leads in active user engagement, with 82% of participants actively using the platform. TikTok follows closely with a significant 60% active user rate, indicating its growing popularity. Instagram captured the attention of 54% of participants, highlighting its status as a preferred platform for visual content sharing. Twitter secured an active user percentage of 49%, while LinkedIn demonstrated its professional networking strength with 28% engagement. Snapchat maintained a respectable 25% active user base.

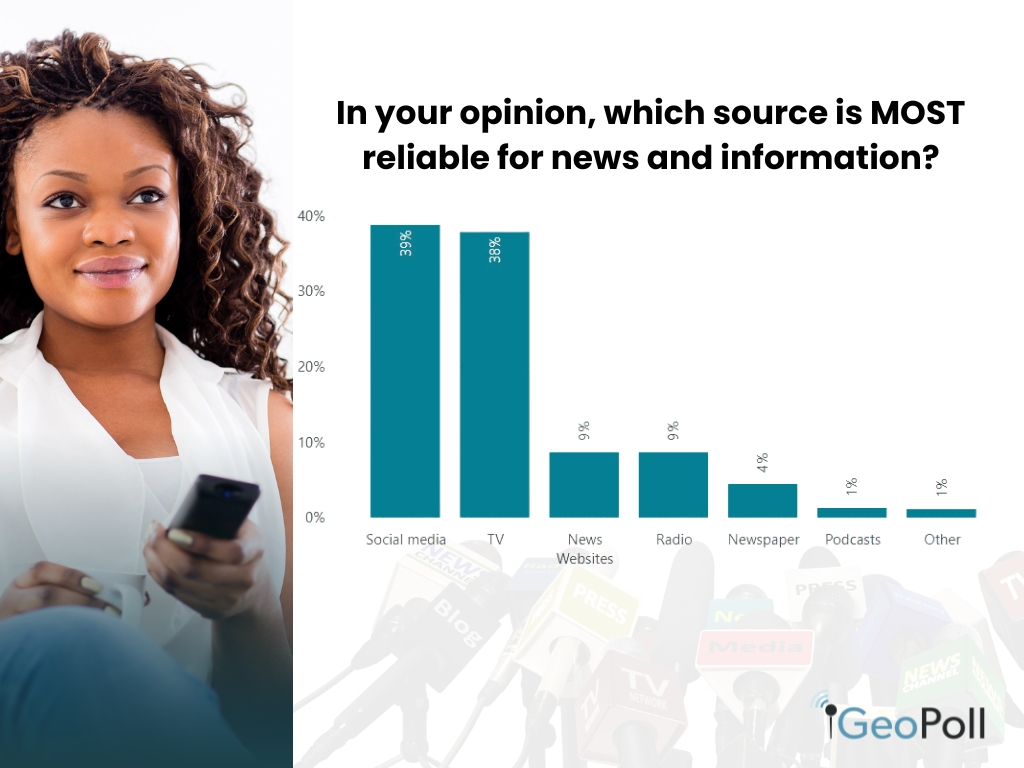

Most reliable platform for news and information

According to 39% of the respondents Social Media is their primary source of news and information. The significant reliance on social media as a primary news source reflects the growing influence of digital platforms in shaping public opinion and disseminating information. This is followed closely by TV, which is preferred by 38% of the respondents, and news websites and radio, which are preferred by 9%.

Which outlet do you trust more: social media or traditional media?

Having a presence on social media allows businesses to establish a sense of trust with consumers. We tend to trust our friends, and if a consumer follows you on social media, it implies that same sense of trust. However, does this still apply to news and information?

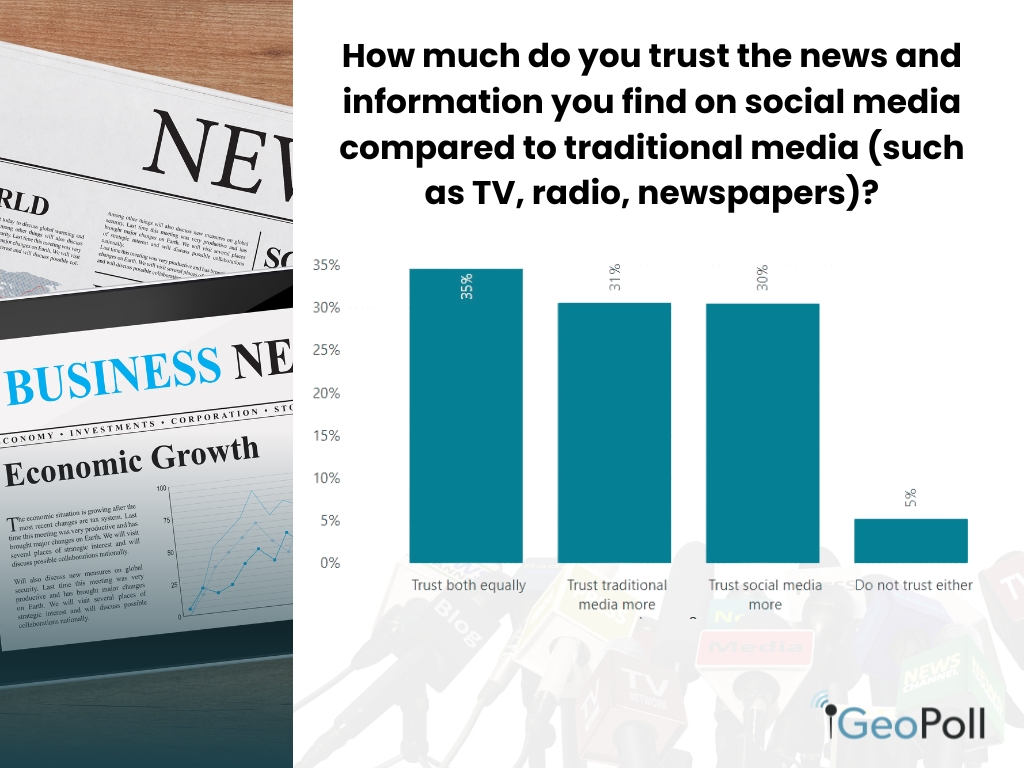

The survey reveals a nuanced perception of trust across media platforms. A significant segment of the population (31%) still regards traditional media as more reliable than social media (30%). This reflects a skepticism towards the credibility of content found on social platforms despite their popularity.

Is traditional media still relevant today?

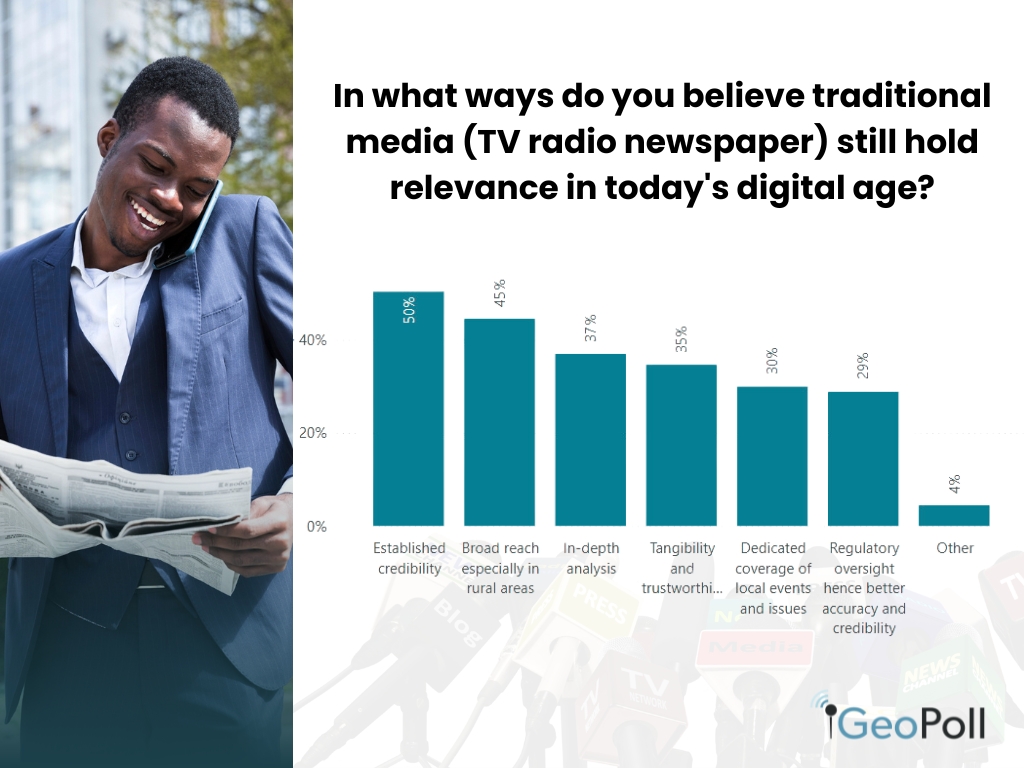

According to half of the respondents, traditional media maintains its societal influence due to its established credibility, another 45% say it’s due to its broad reach, especially in rural areas, and 37% state that traditional media offers in-depth analysis.

Purchasing of news services

Ghana

In Ghana, the survey shows a significant difference in news purchasing habits, with 64% of respondents never having purchased or subscribed to news services. This suggests that most people rely on free or alternative sources for information. On the other hand, 36% have a paid subscription, indicating that a substantial minority is willing to invest in reliable news sources.

Kenya

Kenya has a higher news subscription rate compared to Ghana. The survey showed that 48% of Kenyan respondents have an active subscription, indicating a strong preference for paid news services. On the other hand, 52% do not subscribe, suggesting that a significant portion of the population relies on other sources for news, possibly due to factors such as cost or availability of news content in the country.

South Africa

In South Africa, many people rely on free or other sources for news because the survey reveals that 60% do not subscribe to news services. However, 40% of the respondents pay for a subscription.

Methodology/About this Survey

This Exclusive Survey was run via the GeoPoll mobile application between 25th May and 14th of June 2024 in Ghana, Kenya, and South Africa. The sample size was 2,454, composed of random App users between ages 18 and 60. Since the survey was randomly distributed, the results are slightly skewed towards younger respondents.

To get more details or conduct a scientific study on media usage or other topics in Africa, Asia, and Latin America, please contact us.