- Contents

Survey research is a powerful tool for gathering valuable data across various disciplines. There are many pros, and surveys are instrumental in many big decisions. However, a persistent challenge continues to haunt researchers: low response rates. When a significant portion of the target audience doesn’t participate, the collected data becomes skewed, potentially jeopardizing the entire research effort.

This article discusses the causes of low response rates and explores solutions to boost survey participation.

The Danger of Low Response Rates: Why They Matter

The response rate is often the difference between successful surveys and surveys that fall flat. If the required sample size is 500 and you only manage 350 completes, then that survey might not be representative.

Beyond simply affecting the number of responses, low response rates introduce a critical threat to research validity – nonresponse bias. This occurs when those who choose to participate differ systematically from those who don’t. For instance, if a survey on customer satisfaction has a low response rate, the participants might have particularly strong feelings (either positive or negative), skewing the overall results.

The consequences of nonresponse bias can be far-reaching. It can lead to:

- Misinterpretation of Data: The collected data may not accurately represent the target population, leading to misleading conclusions.

- Unrepresentative Findings: Research findings based on a biased sample may not be generalizable to the broader population.

- Weakened Research Credibility: Low response rates can raise questions about the quality and reliability of the research.

The Culprits: Why People Skip Your Survey

Understanding the reasons behind survey apathy is the first step towards crafting effective solutions. Here’s a closer look at the common culprits:

- Survey Fatigue: The digital age has ushered in an era of constant survey bombardment. People are inundated with requests to share their opinions on everything from household products to political preferences. This continuous barrage can lead to survey fatigue, causing them to ignore yours altogether.

- Survey Design: Confusing questions, unclear instructions, and excessive length are guaranteed turn-offs. Imagine encountering a survey with poorly worded questions that seem more like riddles than inquiries. Frustration sets in, and the “exit survey” button becomes very tempting.

- Relevance: Participation becomes a chore if the survey topic holds no personal interest for the target audience. People are more likely to invest their time if they perceive the survey as relevant to their lives or experiences.

- Incentive: Imagine being asked to spend 20 minutes answering detailed questions with no reward in sight. It’s a tall order. Offering minimal or no incentive creates little motivation to invest time and effort.

- Accessibility: Surveys that aren’t mobile-friendly or lack language options create unintentional exclusion zones. This can significantly limit participation, especially in today’s diverse and tech-driven world.

Strategies to Boost Response Rates

Acknowledging these challenges, researchers can bridge the gap between apathy and active participation. Here are some effective strategies to consider:

- Choose the Most Effective Method: The mode used for the survey matters. If your respondents, for example, use basic phones and have limited internet access, then SMS or CATI will work better than email. It also works to use a mix of methods to get the various bands of respondents. GeoPoll uses a multi-modal mobile approach, which helps us achieve high response rates even in challenging areas.

- Crafting a Compelling Introduction: Set the stage by clearly explaining the purpose of the survey, highlighting its importance to the research field or a specific cause. Briefly estimate the completion time to manage expectations.

- Optimizing for User Experience: Treat your survey like a well-designed website. Ensure it’s mobile-friendly, utilizes clear and concise language, and has a logical flow that effortlessly guides respondents through the questions. This will make the experience smooth and reduce the likelihood of frustration.

- Segmentation is Key: Don’t treat your audience as a monolith. Segment your target audience based on demographics, interests, or other relevant factors. This allows you to tailor the survey content and delivery method to resonate with specific groups, increasing their sense of relevance.

- The Power of Incentives: Consider offering small rewards like airtime, gift cards, the final report, or entry into a prize draw. Incentives act as a nudge, encouraging participation and demonstrating your appreciation for their time.

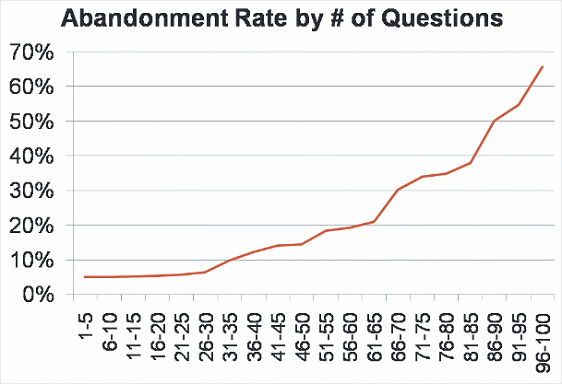

- Respecting Time Constraints: The world is fast-paced, and time is a precious commodity. Keep the survey concise and focused. Aim for 10-15 minutes or less for most surveys. Every minute saved is a victory against survey fatigue.

- Personalization Pays Off: A generic “Dear Participant” email is forgettable. Address participants by name whenever possible and highlight their role in contributing valuable insights. This personal touch can make a significant difference.

- Multi-Channel Approach: Don’t rely solely on email. Utilize social media platforms, targeted online ads, or even phone calls (if appropriate) to reach your target audience and increase their chances of encountering your survey.

- The Art of the Reminder: Strategically sending polite reminders can jog people’s memory and encourage participation. However, avoid bombarding them—strike a balance between reminding and respecting their inbox space.

- Gratitude Goes a Long Way: Always express sincere gratitude to everyone who participates. Thank them for their time and contribution, highlighting the value they bring to your research. This fosters goodwill and encourages them to participate in future surveys.

- Building Trust and Transparency: Ethical data collection practices are crucial for building trust with participants. It is essential to be transparent about how the data will be used and ensure anonymity (when promised).

Bonus Tip: Consider piloting your survey with a small, representative sample before launching it to your entire target audience. This allows you to identify and address any design flaws or areas for improvement before the main survey goes live.

The Bottom Line

By implementing these strategies, researchers can create surveys that are engaging, relevant, and respectful of participants’ time. This, in turn, leads to higher response rates and more reliable data, ultimately strengthening the foundation of your research.

It also helps to have a big enough database of eligible respondents to achieve good response rates. GeoPoll has the largest mobile database of over 300 million survey respondents in Africa, Asia, and Latin America. We use a mix of well-tested, mostly mobile-based methods to conduct reliable, fast survey research while achieving the right, representative response rates. Contact us to learn more about our capabilities.