- Contents

Africa’s financial landscape is complex, comprising a range of economic factors. To better grasp this landscape, GeoPoll conducted a rapid survey of Ghanaians’ and Kenyans’ borrowing habits and debt dynamics.

In this report, we will share the insights we’ve gained from the study conducted in January 2024 in the two countries, offering a glimpse into Africans’ financial behaviour regarding loans and debt.

The survey addressed several pressing topics, including:

- Current financial situation

- Household income

- Financial education and literacy

- Popular lenders

- Challenges experienced while accessing loans/credit

- Loan repayment

- Strategies used to manage and reduce debts

Current financial situation

In October 2022 GeoPoll surveyed Latin America and the Caribbean, Africa, the Middle East, and Asia on the Global Cost of Living Crisis. Part of the findings indicated that rising prices have impacted almost everyone. 75% say prices have “increased a lot,” reducing their family’s standard of living.

Two years on, the same sentiments persists when individuals were questioned about their current financial status. The largest segment, comprising 37.87% of respondents, characterized their situation as neither good nor bad. Subsequently, 22.26% reported their financial condition as bad, while a close 21.37% expressed a positive outlook, saying it was good. Notably, 10.63% conveyed that their financial situation was terrible.

Employment Rate

According to Statista, the unemployment rate in Africa is expected to reach seven percent in 2024. In the period under review, unemployment in the continent peaked at 7.2% in 2021. Unemployment levels varied significantly across African countries. South Africa was estimated to register the highest rate in 2024.

In Kenya, our survey findings indicate that 42.42% of the respondents are unemployed, 35.55% are employed, and 22.04% own their own businesses. Ghana stands out with a more favorable employment scenario, with 50.22% stating they are employed, 40.61% are unemployed, and 9.17% own a business.

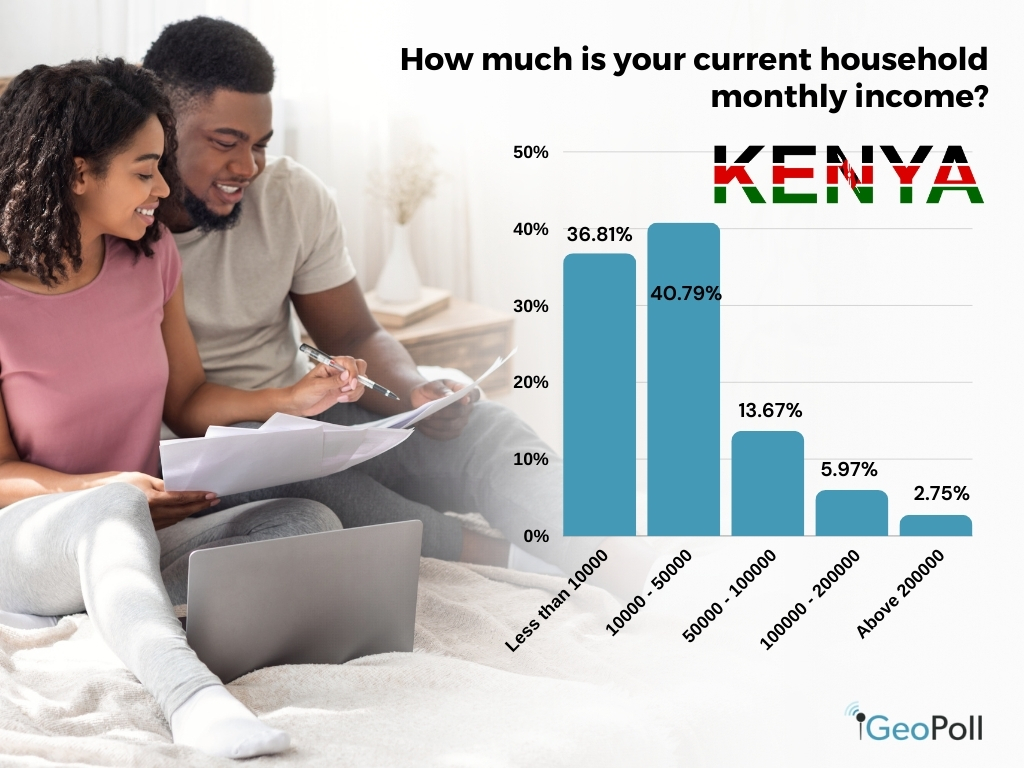

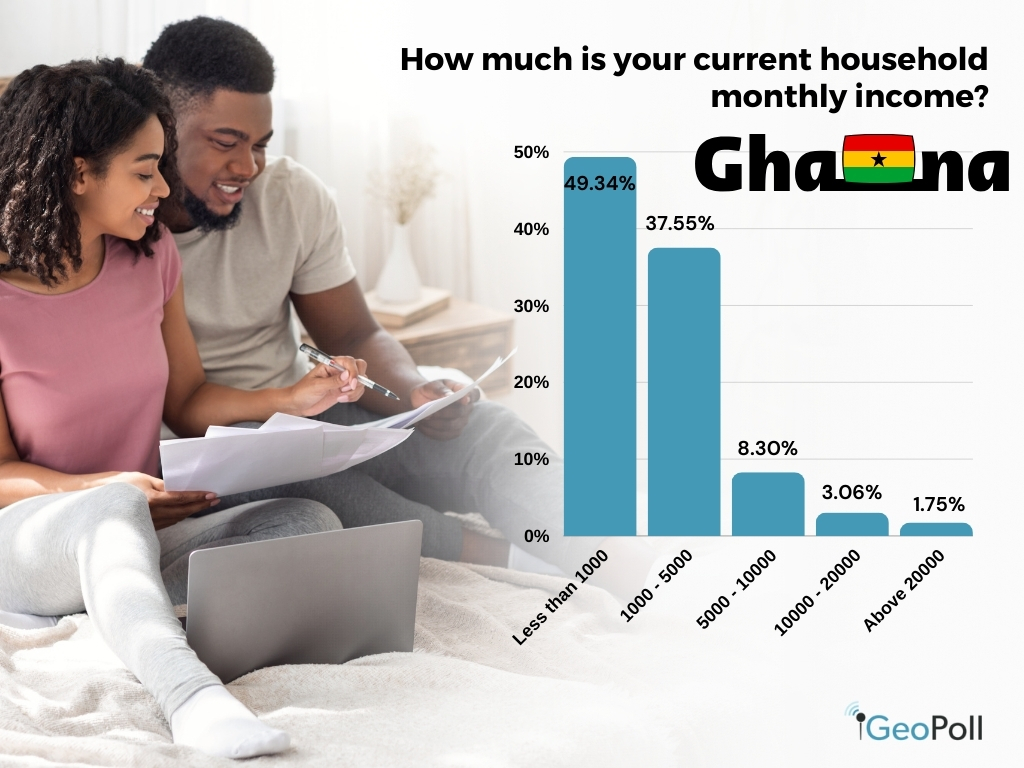

Household Income

According to the World Bank almost 700 million people around the world live today in extreme poverty – they subsist on less than $2.15 per day, the extreme poverty line. Just over half of these people live in Sub-Saharan Africa.

A significant proportion of respondents in Kenya, totaling 40.79%, receive a monthly income within the range of Kes. 10,000 ($61) to Kes. 50,000 ($305). Close behind, 36.81% earn less than Kes. 10,000 ($61). Additionally, 13.67% report earnings between Kes. 50,000 ($305) and Kes. 100,000 ($610), while 5.97% fall into the income bracket of Ke. 100,000 ($610) to Kes. 200,000 ($1,219). Finally, a modest 2.75% indicates earning more than Kes. 200,000 ($1,219).

A distinct trend emerges in Ghana, where 49.34% of respondents earn a monthly salary of 1000 Ghana Cedis ($80). Following closely, 37.55% fall into the income range of 10,000 Cedis ($800) to 50,000 Cedis ($4,000), with a mere 1.75% indicating an income exceeding 20,000 Cedis ($1,600).

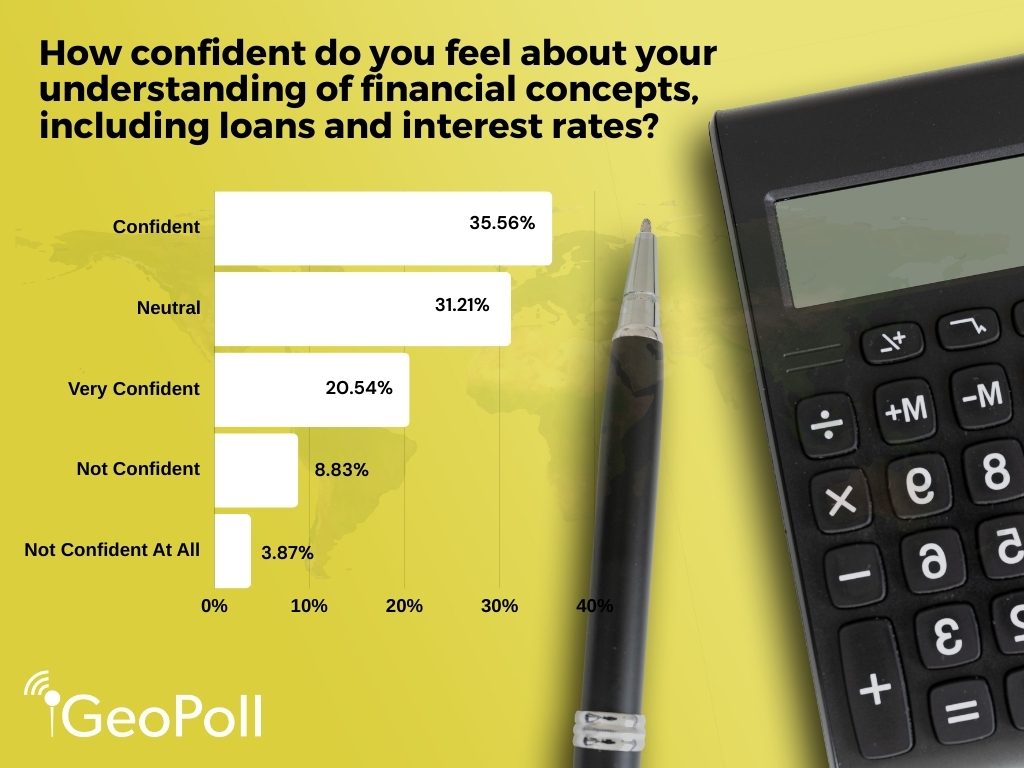

Financial Knowledge

When asked how confident they feel about their understanding of financial concepts, including loans and interest rates, the majority, comprising 35.56%, expressed confidence in their financial literacy. Another 31.21% feel neutral, while 20.54% convey high trust. Interestingly, 12.7% acknowledge a lack of confidence in their financial knowledge.

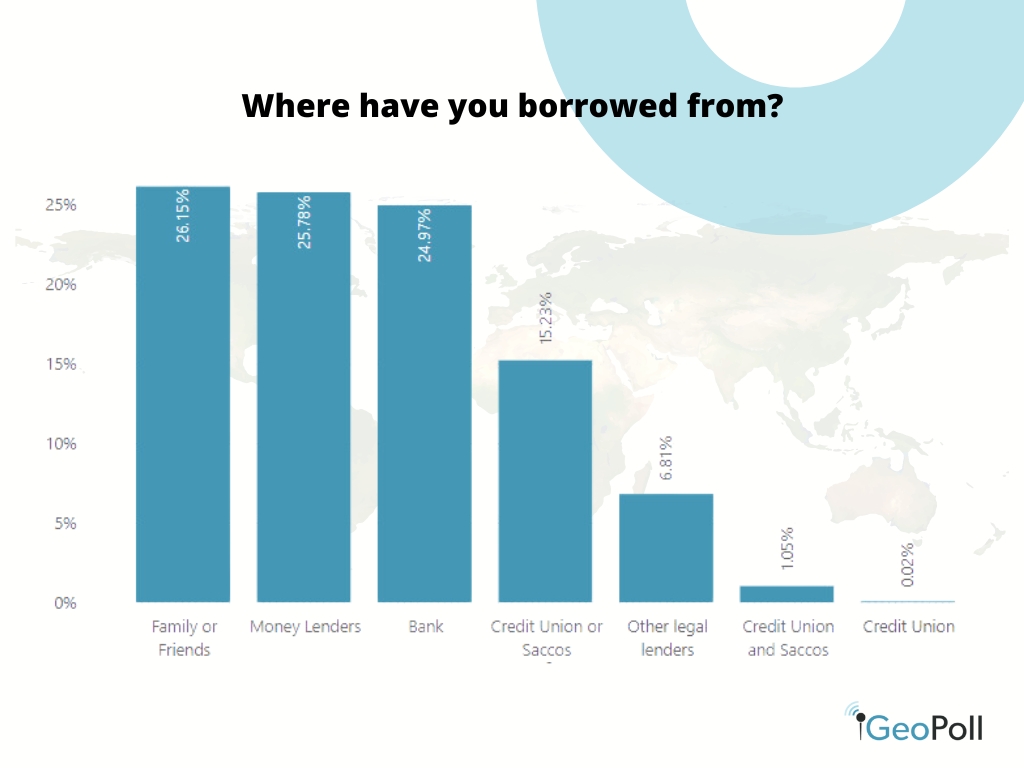

Borrowing Patterns Across Regions

Respondents from the two countries exhibited distinct borrowing patterns. A significant 80.24% have previously borrowed loans or incurred debt, while 19.76% have never sought a loan or debt.

We delved into discovering the primary choices used by people to borrow. Family or Friends emerged as the most favored option, with 26.15%, closely followed by money lenders at 25.78%. Additionally, 24.97% prefer traditional banks, 16.28% opt for credit unions or SACCOS, and 6.81% lean towards other legal means.

Accessing of loans/credit

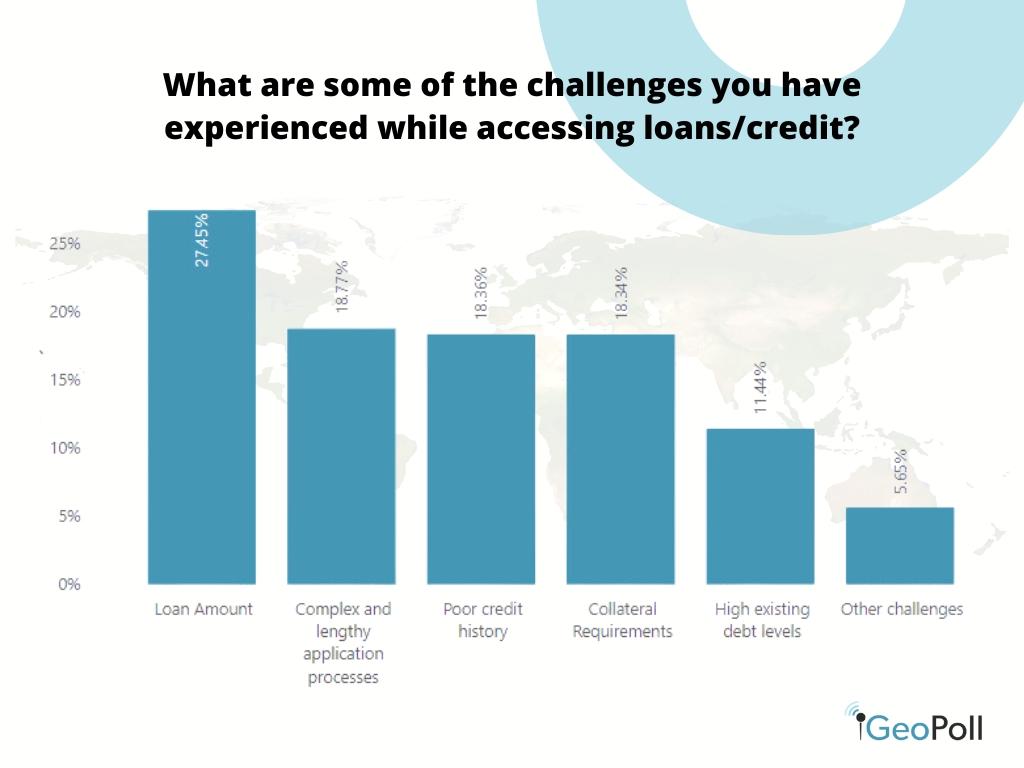

With a significant majority, 77.16%, expressing challenges in accessing loans, we delved into the reasons behind these difficulties. Among the respondents, 27.45% attributed their challenges to inadequate loan amounts, 18.77% lamented the lengthy and challenging application process, and 18.36% cited a poor credit history for loan denials. Collateral requirements were identified by 18.34% as a hindrance, and 11.44% pointed to their high debt levels as contributing to their loan access challenges.

Use of Loans

The survey highlighted the diverse purposes for which Africans seek loans. Education is the predominant purpose, with 40.17% utilizing loans to support their studies. Medical needs follow closely at 20.59%, while 17.53% secure loans for home or mortgage purposes. Another 12.05% seek financial assistance for personal interests, 4.87% for entertainment purposes, and, lastly, 4.80% specifically for auto or car loans.

Debt Management

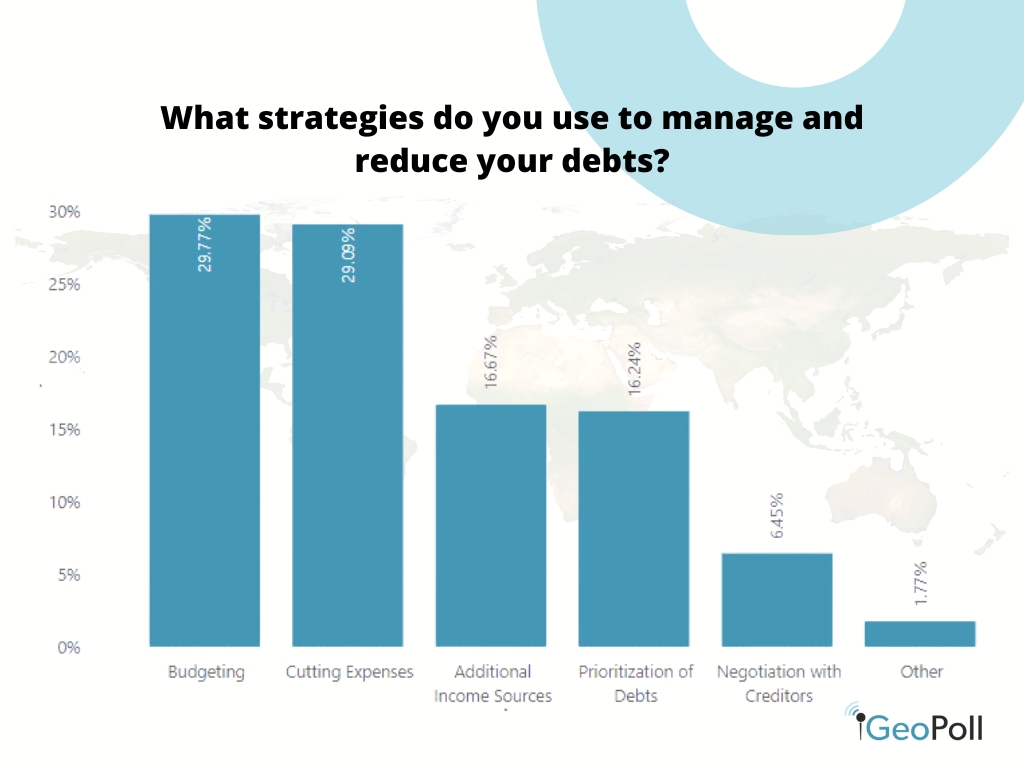

With 81.12% of respondents acknowledging challenges in repaying loans or debts, we also explored the strategies employed by individuals to manage or alleviate their financial burdens. Notably, 29.77% of respondents adopt budgeting as a means of debt management, while 29.09% opt to reduce their expenses. Additionally, 16.67% seek to enhance their income by exploring additional sources, 16.24% prioritize their debts, and 6.45% negotiate with lenders or creditors.

What’s next?

As we embark on the new year, financial considerations take centre stage for many individuals as they strategize around their goals and aspirations. According to The Ascent, 82% of millennials and 74% of Gen Zers intend to establish financial goals for the coming year, surpassing the figures for Gen Xers at 69% and baby boomers at 49%.

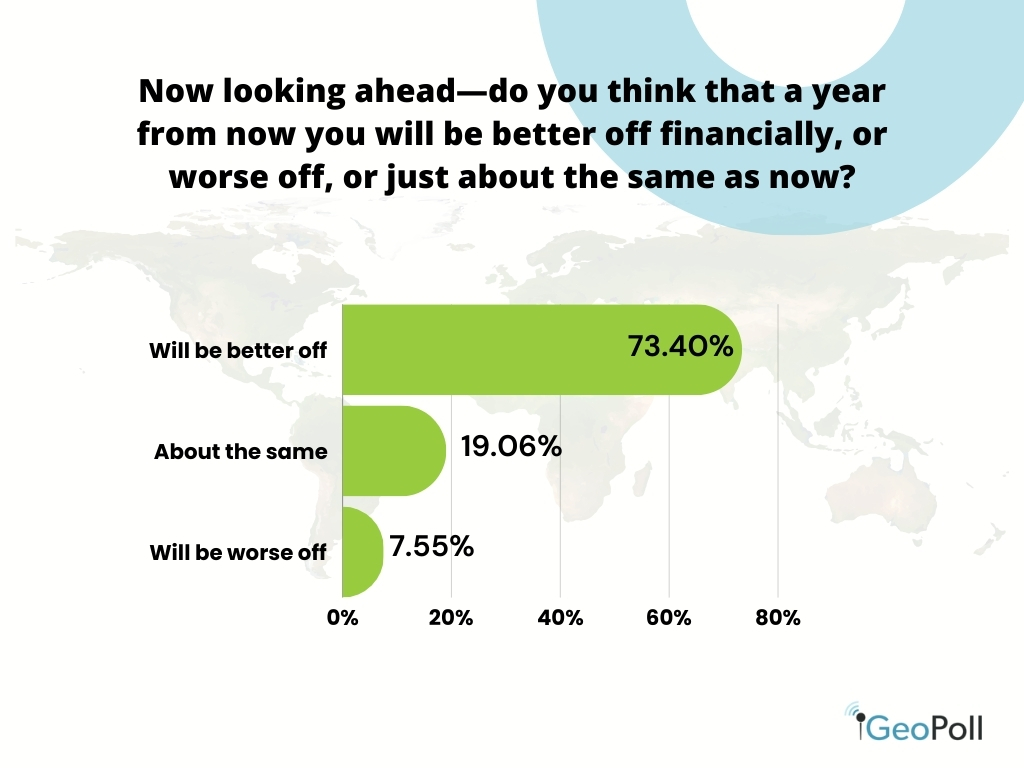

When questioned about their financial outlook for the new year, a significant majority, 73.40%, express optimism that their financial situation will improve, meanwhile, 19.06% anticipate their financial status to remain unchanged, and 7.55% think they will be worse off.

Methodology/About this Survey

This Exclusive Dipstick Survey was run via the GeoPoll mobile application in January 2024 in Ghana and Kenya. The sample size was 3,290, composed of random users between ages 18 and 60. Being an app survey, the sample was skewed towards younger age groups, males, and urban dwellers.

To get more details about exclusive GeoPoll surveys or to conduct a scientific study on finances or other topics in Africa, Asia, and Latin America, please contact us.