- Contents

If you are a working business professional these days, you likely haven’t been able to surf the web without seeing at least one ad or article mentioning something like, “learn how to adapt to a rapidly changing market”, for some time now. While I assure you this post is not like all the others, it is rooted in the curiosity about just what changes have occurred in purchase decisions in the FMCG space due to the coronavirus pandemic.

In March, GeoPoll ran a comprehensive study on consumer behavior and purchasing decisions in Kenya’s FMCG space. As this study occurred before the pandemic spread widely, we decided to utilize that data for a comparison study of the FMCG space and how it has changed during COVID-19. So, we ran the same questionnaire again and analyzed the differences in reported purchase decisions. This report will outline what was found, like an increased influence placed on the quality of disinfectants and more people making purchases based on convenience.

Methodology

This report will compare results from two rounds of survey research that were conducted in Kenya. Both the first round and second round of the study were conducted via mobile web and the questionnaires were identical. Round one of the studies ran from March 10th to March 16th, meaning the results reflect purchasing behavior before COVID-19 related stay at home guidelines were enacted by the Government of Kenya. As such, the results from round one will serve as a baseline for purchasing decisions on FMCG products in Kenya before the coronavirus pandemic. The second round ran from October 3rd through October 6th and the results from this round will reflect the changes in purchasing behavior of FMCG products due to the coronavirus pandemic.

Both round one and two had 400 respondents located in the following urban centers throughout Kenya: Mombasa, Nairobi, Nakuru, Nyeri, Kiambu, Kisumu, Machakos, Meru, Uasin Gishu, Bungoma, Homa Bay, Kilifi, Vihiga. The gender split was 50% male and 50% female in the first round and 51% male and 49% female in the second round. There were 33% of respondents in each of the following age groups for the first round, 18-24, 25-34, 35+. In the second round, 18% of respondents were 18-24, 42% of respondents were 25-34, and 31% of respondents were over 35.

Most Frequently Purchased FMCG Products in Kenya

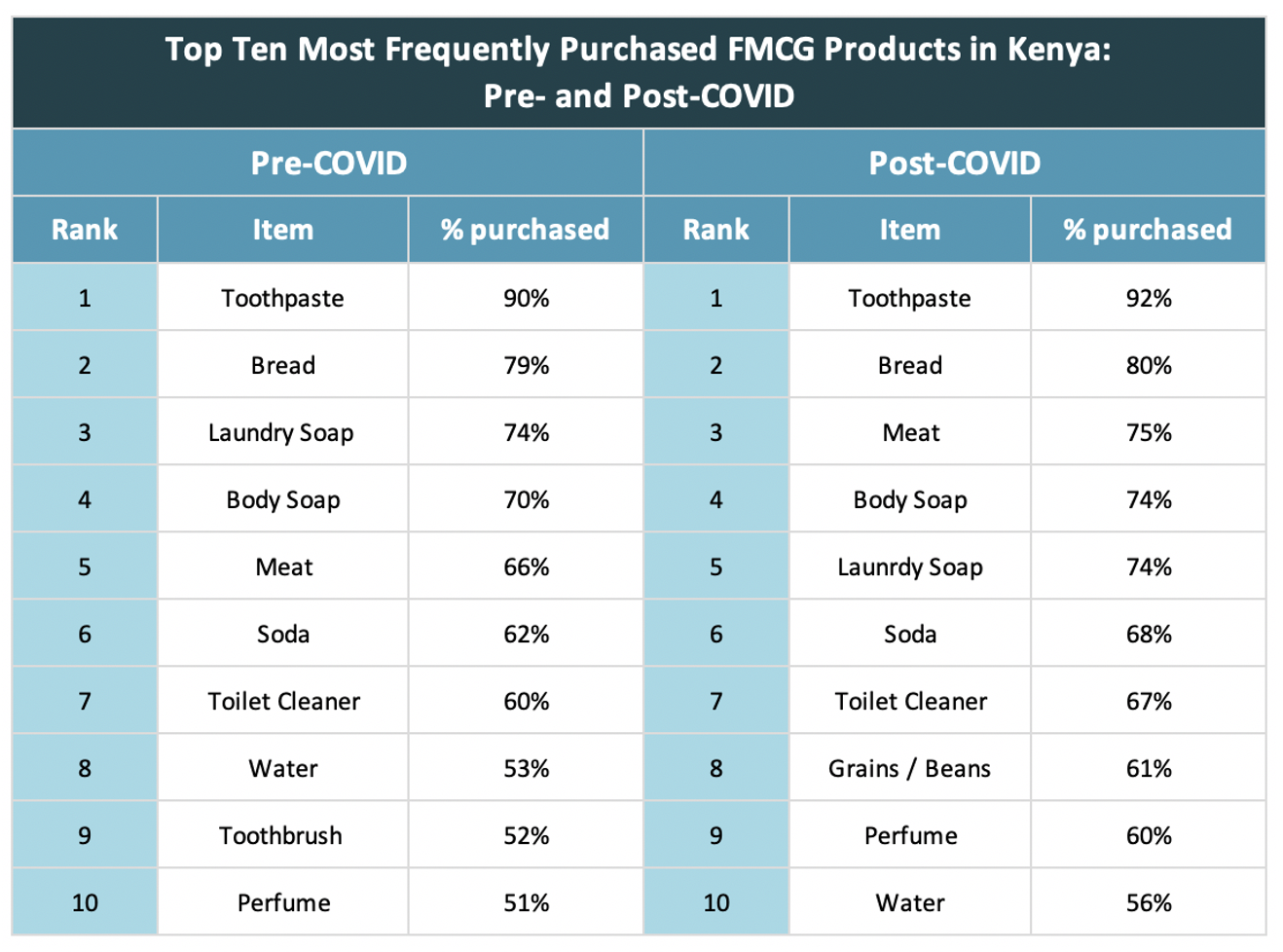

Both of the questionnaires began with a list of over 30 FMCG products that fall into seven categories: dental hygiene, soap, hair care, cleaning, beauty, food, and beverages. Respondents were asked to indicate whether or not they had purchased each of the items listed within the past 30 days. The table included above shows the top 10 most purchased items from each of the studies.

The top two most purchased items were toothpaste and bread in both rounds of the study and the percentages did not fluctuate more than 2% each. Although the percentage of respondents that purchased laundry soap within the 30 days preceding the survey remained the same, laundry soap dipped from 3rd place to 5th place from pre- to post-COVID. Converse ranking changes occurred for meat purchases from the first to the second round, although meat purchases were made 9% more in the post-COVID round than in the pre-COVID round. Also notable is the increased purchases of grains and beans, which replaced toothbrushes on the top 10 list.

Factors Influencing Purchase Decisions of FMCG Products in Kenya

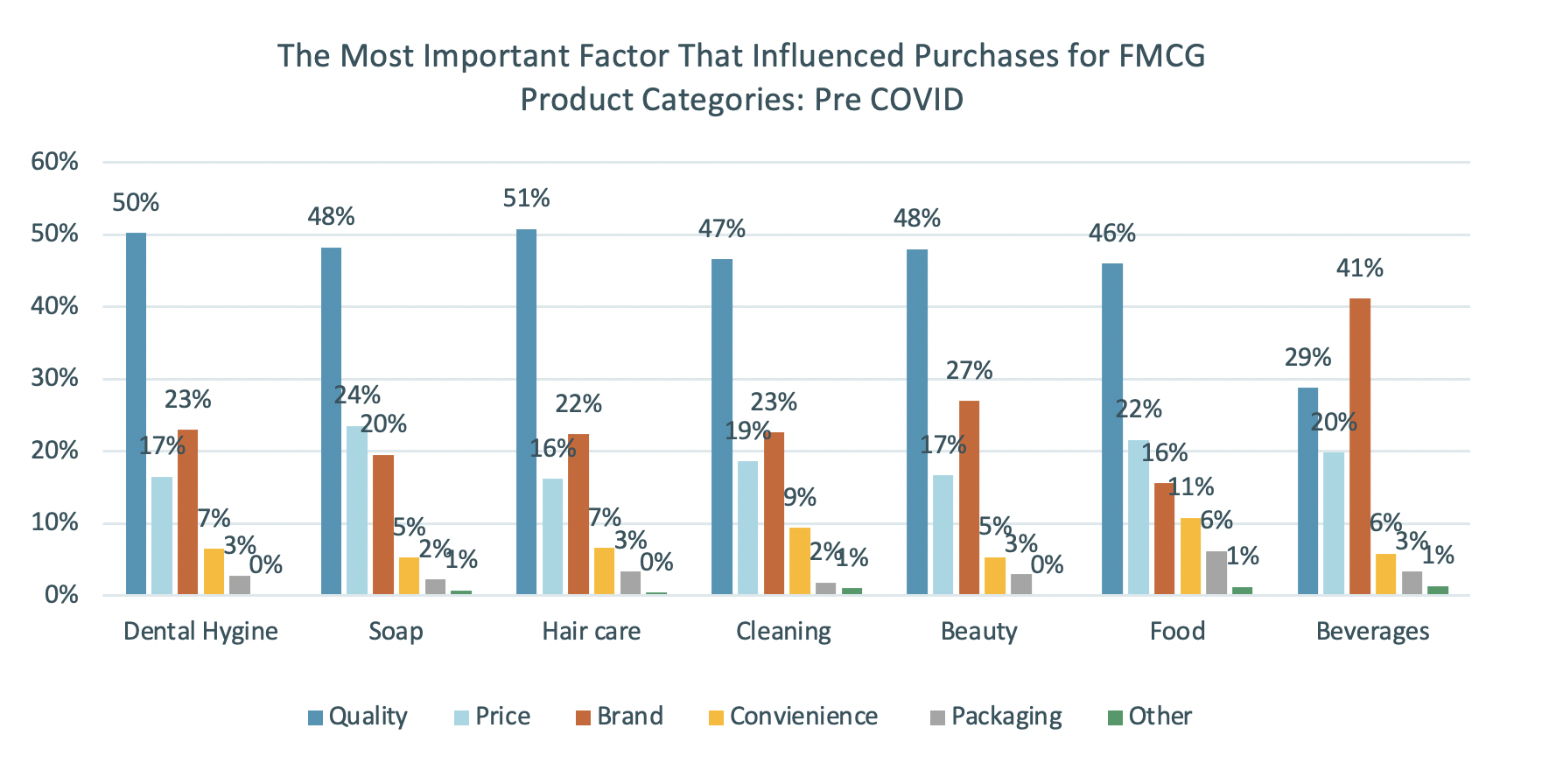

In past studies on Kenyan consumer behavior, it has been found that consumers are price-aware and brand loyal, yet tend to justify paying higher prices in exchange for quality products. The data collected in both rounds of these studies generally reflect such findings.

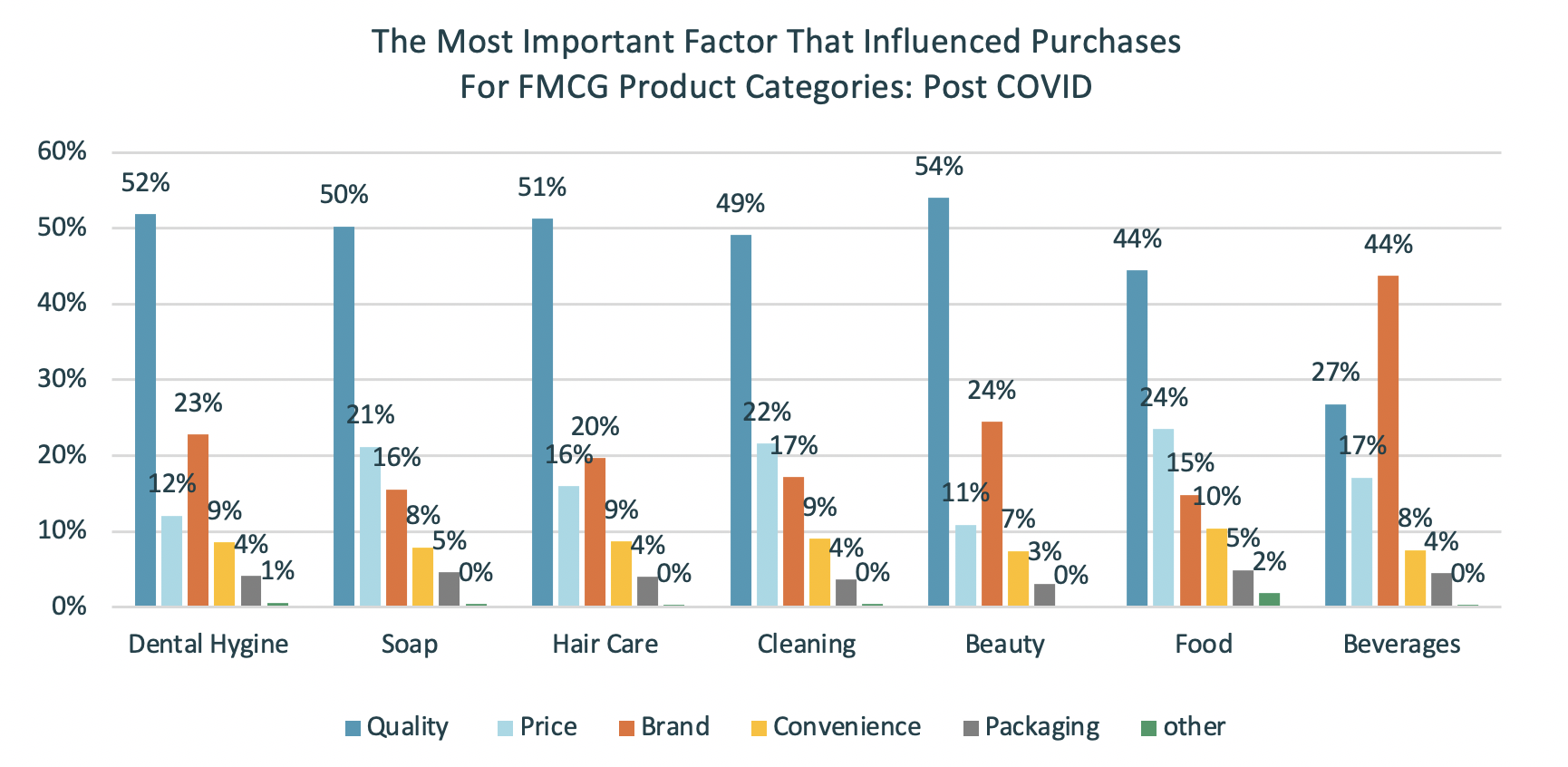

Overall, the results of the studies showed that quality was by far the key driver of FMCG purchases. In every product category other than beverages, quality influenced purchases at least 20% more than any other factor in both rounds. When comparing the studies against one another, there was even a slight increase in the role that quality played in the purchases reported in round two, which indicates that quality plays an even more important role in FMCG purchasing decisions in a post-COVID era than the pre-COVID era.

Considering the charts above, the most important factors that influenced purchasing decisions from round one to round two were minimal; however, when the results are looked at by item individually rather than by category, there are some interesting insights about how COVID has changed consumer’s buying behavior.

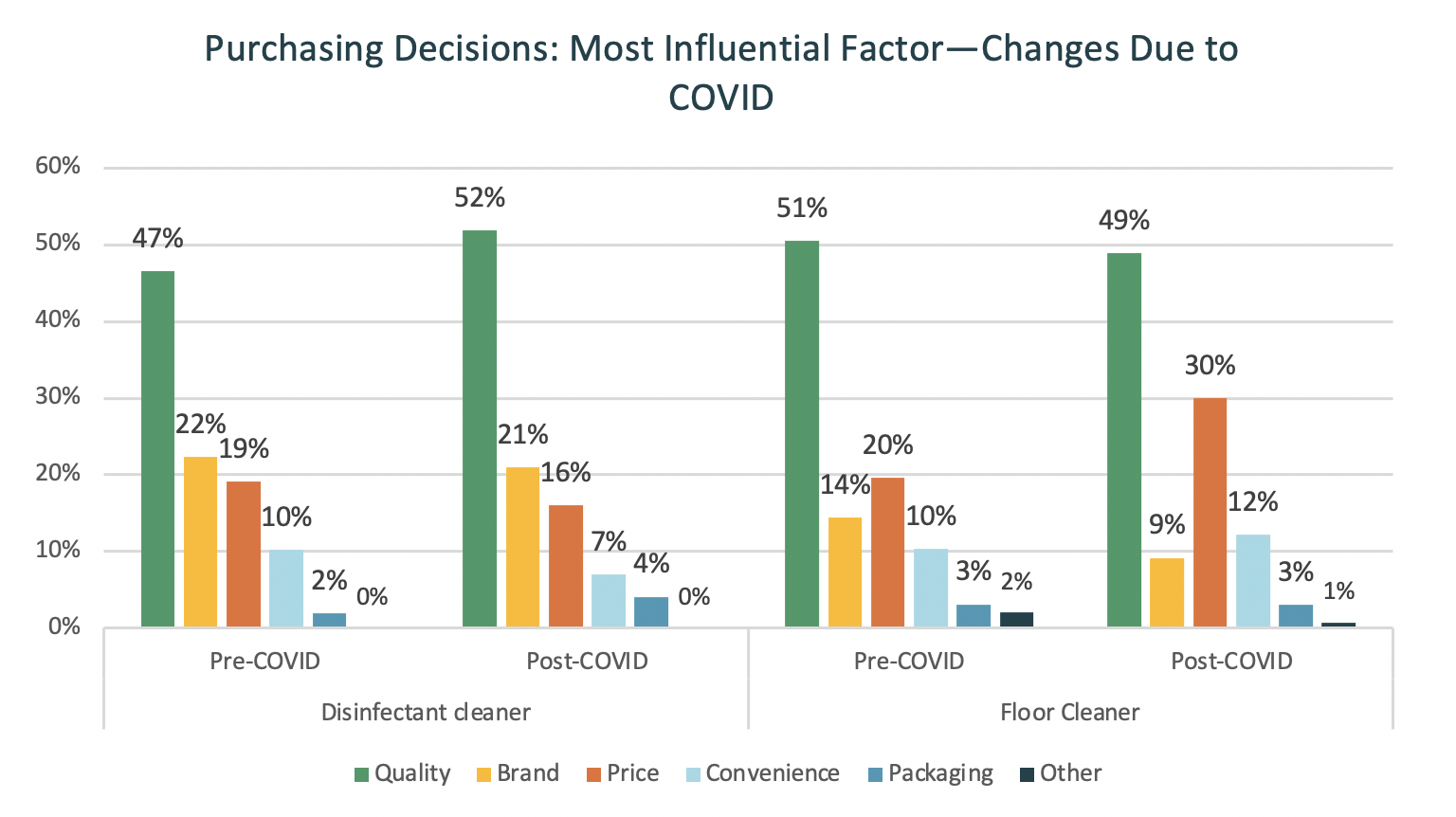

Within the cleaning category, disinfectant cleaner and floor cleaner had somewhat opposite changes from before the pandemic to after the pandemic. Disinfectant cleaner purchases were driven 5% more by quality after the pandemic than before, while floor cleaner purchases were driven 2% less by quality, 5% less by brand, and 10% more by price. These changes are likely due to the pandemic and consumer’s general concern about killing the coronavirus.

Although the differences were rather small, similar differences in key influences of purchasing decisions before verses after the pandemic began were seen for other products as well. For example, the influence of price increased for non-essential FMCG items, like window cleaner, hair oils, and mouthwash, while the influence of quality increased for health-related items like produce, meat, and disinfectant cleaner. Interestingly, the influence of quality did not increase for one of the most essential items during the COVID pandemic: hand soap. The largest change seen for hand soap was an increase in the influence convenience had on purchases, which is likely due to consumers needing to purchase more frequently than usual due to diligent hand washing practices for virus prevention.

Key Takeaways: GeoPoll Research Solutions for the FMCG Space in Kenya

GeoPoll’s mobile research solutions are a flexible resource for gathering insights on consumer behavior. Data-driven decision making is crucial when adapting to a rapidly changing market, like the market during the ever-evolving coronavirus pandemic. For more information on how GeoPoll can gather valuable data for your team, contact us today.