Case Study: Financial Perceptions in Cote D’Ivoire

Opinion & Public gathers vital data on financial services in Cote D’Ivoire

Background

Cote d’Ivoire is one of Africa’s fastest-growing economies, boosted by recent reforms to the financial sector that have been praised by groups such as the International Monetary Fund. The number of people who have access to financial services has also improved in the past few years. While in 2016, the World Bank found that only one in eight people used formal banking accounts for savings, the introduction of digital financial services has seen an increase in financial inclusion.

With this background, Opinion & Public, a leading public relations firm in Francophone Africa and based in Cote D’Ivoire, sought to understand perceptions of various financial sector services, including mobile money services, commercial banks, mortgage institutions, insurance providers, and more. By examining the factors that affect the performance and uptake of different financial services, Opinion & Public can advise those in the financial industry on the latest trends.

Methodology

A total of 789 respondents from Cote D’Ivoire participated in the study. The gender and age distribution of respondents was 67% male to 33% female, and 34% ages 18-24, 45% ages 25-34, and 21% ages 35 and above. The majority of the respondents were in the 8 to 12 range of the Living Standard Measures. Respondents came from across the country, with 23% located in the financial center of Abidjan.

Results

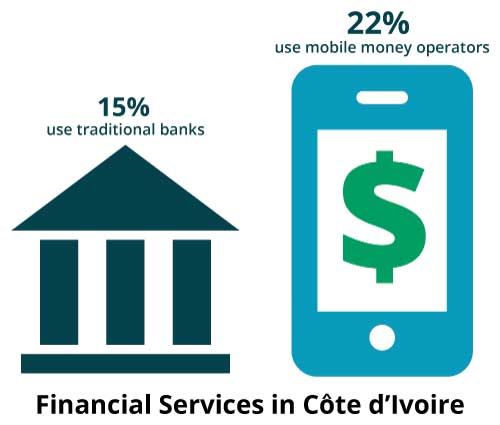

Results demonstrate the prevalence of non-traditional financial services solutions such as mobile money operators. While 36% reported they were aware of commercial banks, only 15% of the total sample currently use a commercial bank, compared to 40% who were aware of mobile money operators and 22% who currently use a mobile money operator. Insurance providers had relatively high awareness, at 30%, but low uptake, with only 9% of respondents currently using an insurance provider. Microfinance banks, which provide small loans to those who may not otherwise have access to business or personal loans, had 29% awareness, but only 10% currently use these banks.

Banking And Insurance

Of those who use banks, debit cards are more popular than credit cards, with 60% of bank users using debit cards, compared to 36% who use credit cards, demonstrating that credit is still a less common service in Cote D’Ivoire. The study also found that the majority of banking customers are using their banking services monthly or less, with only 11% stating that they use banks weekly or daily. For those who do not use banks, the biggest barriers are a lack of money/finances and unemployment, demonstrating that consumers associate the ability to have a bank account with a higher level of earnings. A majority of bank users, 57%, state that they also use mobile money, showing the ubiquity of mobile money platforms among all segments of the population.

Of the 9% overall who currently have insurance, health insurance and life insurance are the most popular types of coverage. The study found similarities among those who do not have bank accounts and do not have insurance, with the most common reasons for not having insurance being unemployment and lack of finances.

Mobile Money

Mobile money has revolutionized finances in countries such as Cote D’Ivoire. Mobile applications are convenient to send and receive money and are available to consumers at all income levels. This study found that receiving money and purchasing airtime were the most common uses of mobile money applications, with 36% and 21% respectively stating they use these functions. The fast, user-friendly, and secure nature of mobile money transactions are the main drivers for people starting to use mobile money. Of those who do not use mobile money, the main factor is a lack of finances.

Mobile money has revolutionized finances in countries such as Cote D’Ivoire. Mobile applications are convenient to send and receive money and are available to consumers at all income levels. This study found that receiving money and purchasing airtime were the most common uses of mobile money applications, with 36% and 21% respectively stating they use these functions. The fast, user-friendly, and secure nature of mobile money transactions are the main drivers for people starting to use mobile money. Of those who do not use mobile money, the main factor is a lack of finances.

Perceptions Of Financial Services

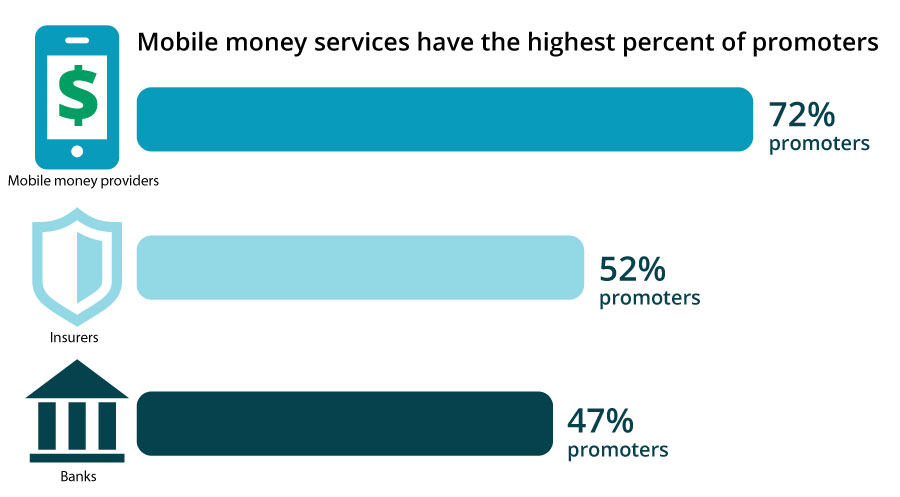

In order to examine the perceptions of various financial services in Cote D’Ivoire, this study calculated net promoter scores. Based on responses, respondents were divided into promoter, detractor, and neutral groups. Mobile money services had a much higher proportion of promoters, at 72%, than both insurance companies, with 52% promoters, and banks, at 47% promoters. These findings demonstrate that the perceived ease and availability of mobile money has led to these applications being viewed more favorably than traditional financial services.

For banks, customer service (both good and bad), and reliability and security were among the most cited reasons given for the net promoter scores. Reliability was also cited as an essential factor in the net promoter score for insurance companies. Despite mobile money services being less established than traditional banks, reliability and security were also mentioned when rating mobile money providers. Other features that factored into the net promoter score for mobile money providers included the availability and fast nature of mobile money.

Impact

Opinion & Public is committed to creating a positive narrative around the financial services providers in Francophone Africa and is using this data internally to build strategies to effectively engage audiences in Cote d’Ivoire. Increasing the awareness and accelerating the growth of financial services in Cote d’Ivoire will improve development in the sector and bring financial services to greater portions of the population. This survey provides greater understanding of the perception and use of financial services in Cote D’Ivoire, and will allow banks, insurance companies, mobile money applications, and government authorities to tackle the challenges surrounding financial services in the country.