Case Study: Digital Lending Grows in Popularity in Kenya

The Digital Lending Association of Kenya measured usage of digital loans

Background

Kenya has been at the forefront of providing digital financial services for over a decade. The proliferation of mobile-based banking and lending platforms has provided unbanked populations with access to financial services and increased financial inclusion by over 50%. Digital lending, which provides people with easy access to loans of various amounts, has been especially popular, and there are now an over 120 digital lending platforms in Kenya. Despite this, until recently the sector had been largely unregulated, and there was little data available on who is taking out loans and how they are being used.

The Digital Lenders Association of Kenya (DLAK) is a new member organization incorporated in 2019 bringing together the leading digital-first loan providers and associated stakeholders to facilitate mutual growth in the digital lending sector in Kenya.

The main objective of the organization is to set ethical and professional standards in the industry, to collaborate with policy makers and other stakeholders in addressing industry issues, contribute to knowledge and learning and to drive the overall growth of the digital lending and Fintech sector in line with the Economic Pillar of the Vision 2030, MTP III and the Big Four Agenda.

The Digital Lenders Association of Kenya commissioned GeoPoll to conduct a study which aims to better understand the audiences and motivations for digital lending.

Methodology

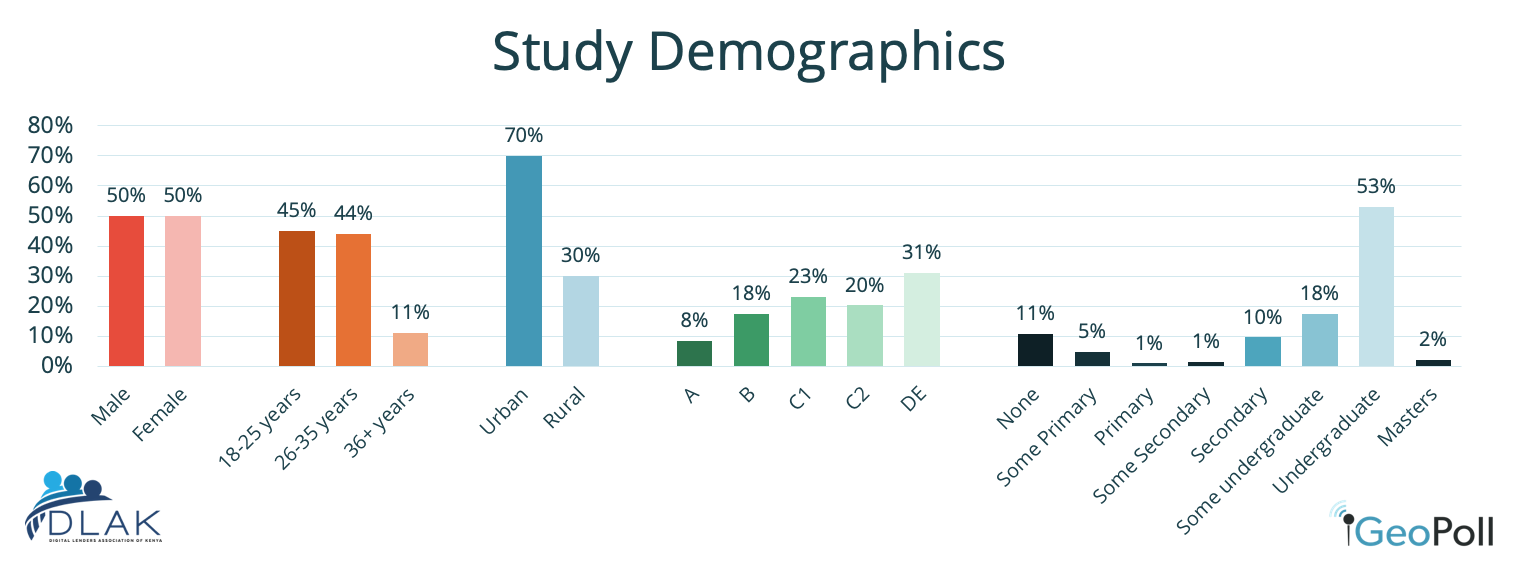

The study was conducted via SMS in December 2019, with over 4,000 who answered the initial questions and 1,000 respondents who completed the study after indicating they had taken out a digital loan in the past 6 months. There was a 50/50 gender split, and a 70/30 urban-rural split. Respondents were 18+ and located throughout Kenya.

Results

The study found that 71% of over 4,000 total respondents reached had taken out a mobile loan in the past 6 months. While males and females were equally likely to have taken out a loan, those aged 36 and older and those in rural areas were less likely to have taken out a loan than younger, urban populations.

Highlights of the findings include:

- Of those who had taken out a mobile loan, satisfaction levels were reported as high, with 83% saying they were highly satisfied with their mobile lending experience

- Of those who had taken out a mobile loan, satisfaction levels were reported as high, with 83% saying they were highly satisfied with their mobile lending experience

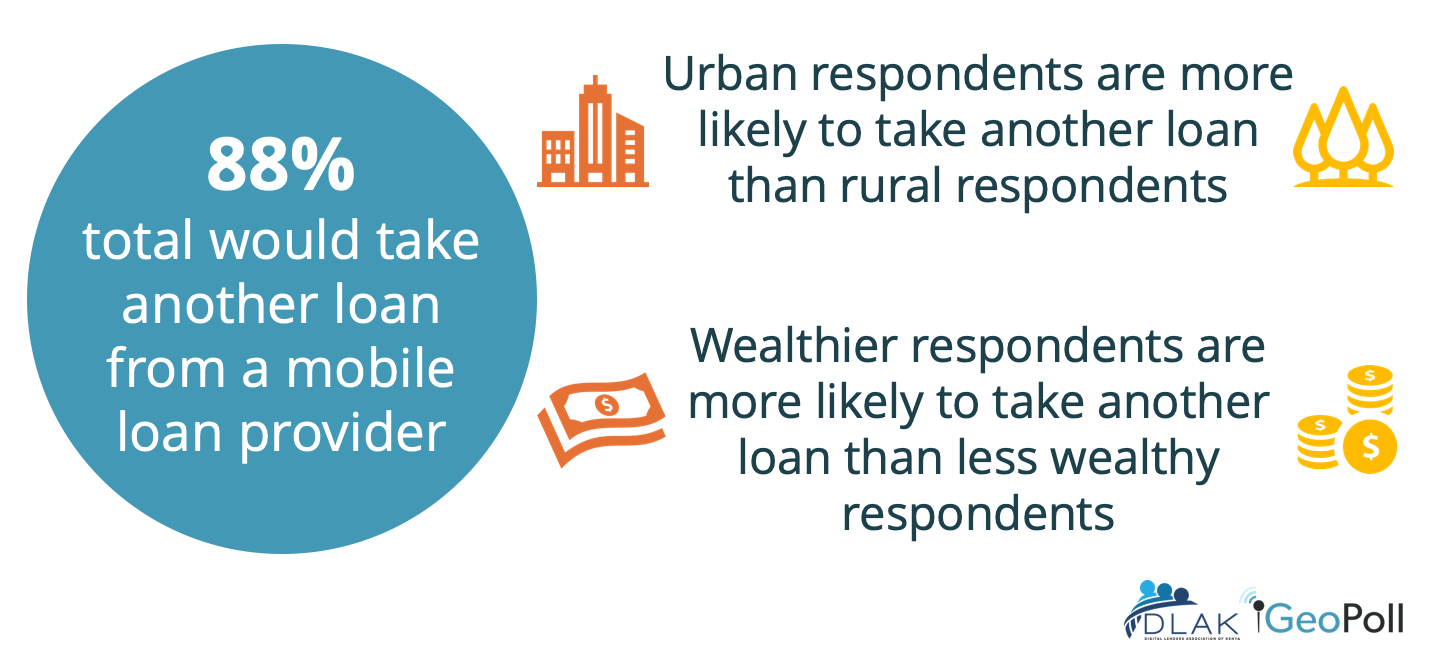

- 88% said they would consider taking another loan out in the future.

- The majority of those taking out loans are doing so for personal use, with 66.5% stating they have taken out personal loans, and 33.5% using loans for business.

- The reasons for taking a personal loan are varied, but 41% used the loan for household expenses or bills, while 23% cited emergency expenses and 20% medical expenses.

- Business loans were primarily used to purchase goods, with 53% of business loans being for goods purchase, and 19% for emergency expenses.

- 84% of those who took business loans stated that there was a growth in their business due to the loan, and 45% said that they would not have another credit option if not for the mobile loan.

The study also demonstrated that consumers are drawn to the convenience of mobile-based lending: Getting loans any time of the day, having loans be approved without paperwork, and receiving money quickly were the most important features to users of mobile or web loans.

The infographic with results can be found here: DLAK Infographic.

Impact

By using a mobile methodology, DLAK was able to quickly reach respondents throughout Kenya who use digital loans to better understand their experiences. This study will be used by DLAK and the digital lending sector to further grow their services in line with the needs and desires of Kenyans taking out loans. “The digital lending sector has grown exponentially in the past few years, and this study demonstrates the universal appeal of fast, easy to access digital loans for a multitude of purposes,” stated Robert Masinde, Chairman DLAK.